Clicks and Consequences: The Political Theater of Punishing a Digital Economy

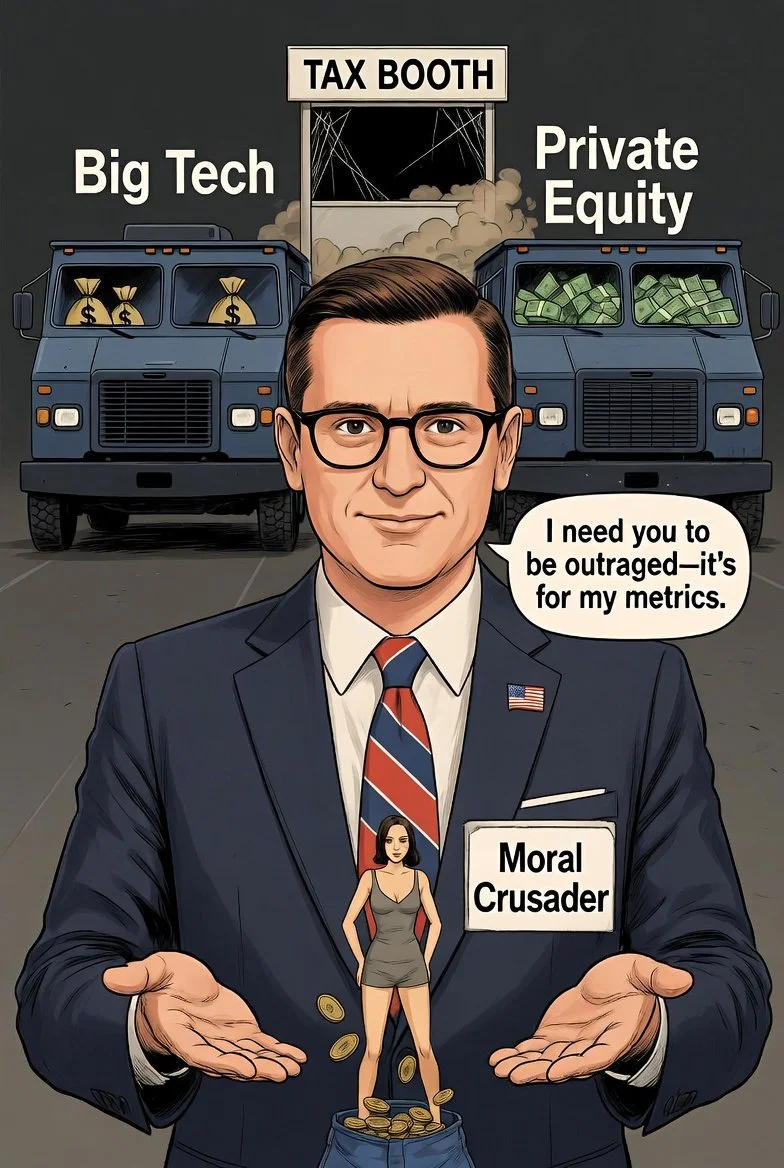

In a proposal that has ignited fierce debate over power, morality, and tax fairness, 31-year-old investment CEO running for Florida governor James Fishback, has singled out the content platform OnlyFans for a punitive state tax of 50%—later threatening 100%—on income earned by Florida residents. Framing the platform as exploitative “online degeneracy,” the candidate aims to fund teacher raises, school lunches, crisis pregnancy centers, and men’s mental health programs through this highly targeted levy. Critics immediately labeled the move a selective moral crusade that exposes glaring double standards, noting that the candidate’s own world of high finance routinely leverages loopholes and offshore shelters to minimize tax burdens.

The proposal took direct aim at 21-year-old creator Sophie Rain, who publicly stated she earned millions of dollars on the platform. Rain fired back, highlighting that she already pays a 37% federal tax rate and challenging the candidate’s focus. “He’s an investment CEO talking about exploitation while Wall Street banks dodge taxes on a scale we can’t imagine,” exclaimed Rain via X. “This isn’t about morality—it’s about targeting a visible, mostly female industry to score political points.” She warned that such a tax would trigger an exodus of creators from Florida, draining state revenue rather than increasing it.

Legal experts express deep skepticism about the proposal’s viability. Florida famously has no state income tax, and a discriminatory tax on a single lawful industry would face immediate constitutional challenges. This is less a serious tax plan and more a political spectacle, it uses the guise of funding popular causes like teacher pay and school lunches to legitimize what is essentially a punitive moral judgment against a legally operating sector.

The move echoes historical sin taxes and regulatory tactics long used to police morality and control marginalized communities. Just as vice laws were once weaponized against Black entrepreneurship and social autonomy, critics say this degeneracy tax seeks to financially penalize a largely young, diverse, and female-driven form of digital enterprise under the banner of public virtue.

Our analysis finds the proposal to be fundamentally flawed. It is performative—an investment financier condemning a creator’s revenue stream. It is discriminatory—isolating one industry for extraordinary burdens. It is economically naive—risking the flight of skilled digital entrepreneurs and their taxable income. And it is legally dubious—contradicting Florida’s foundational tax structure. This is not sound policy; it is the weaponization of tax code for political theater.

Political observers note the proposal fits a modern campaign formula: in a crowded media landscape, outrage drives visibility. The candidate’s escalation from 50% to a mathematically impossible 100% tax within hours confirms the dynamic. The strategy is less about drafting viable legislation and more about generating incendiary headlines, provoking fierce backlash, and securing national name recognition. This cycle trades substantive debate for viral engagement, where even widespread condemnation serves the core goal of relevance.

Ultimately, this degeneracy tax proposal exposes a dangerous intersection of political strategy and policymaking. It leverages a historic playbook of marginalizing a legal industry under moral pretense, while its economic and legal foundations crumble upon inspection. The escalating rhetoric, from 50% to a blatantly unworkable 100%, confirms its true purpose; not to fund schools or meals, but to purchase relevance through calculated outrage. This should serve as a stark reminder that the fight for justice must now also discern and dismantle performances of governance—spectacles that sacrifice vulnerable workers, sound economics, and substantive debate for the fleeting currency of virality. The challenge for Floridians is to see beyond the spectacle and demand a fairness that is broad, genuine, and just.

HOME | NATIONAL | HEALTH / LIFESTYLE | FINANCE | SPORTS | TECH | MUSIC / ENTERTAINMENT | OPINION